What is the Mudra Loan?

The Honorable Prime Minister’s program, launched on April 8, 2015, for loans of up to 20 lakhs to non-corporate, non-corporate, small/micro enterprises is Pradhan Mantri MUDRA Yojana (PMMY).

This credit is known as a PMMY MUDRA loan. Commercial Banks, RRBs, small banks, MFIs and NBFCs provide those loans.

Types of Mudra Loan:

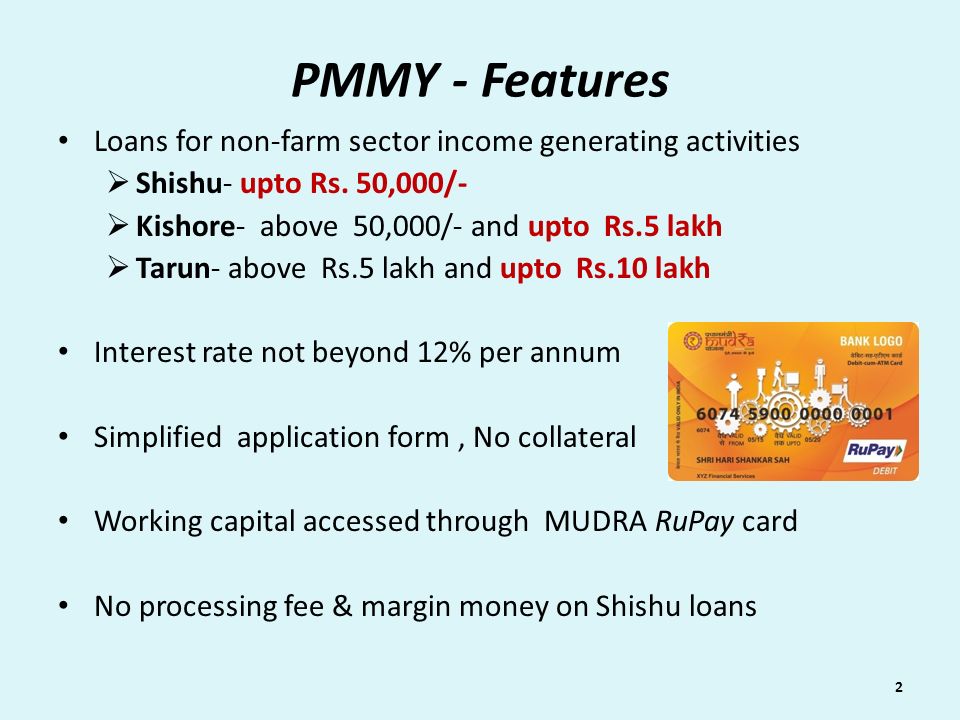

In the framework of PMMY, MUDRA produced three products: ‘Shishu’, ‘Kishore’ and ‘Tarun’ which are the indicators of the microunit beneficiary/growth entrepreneur’s and development needs and provide a reference point for the next phase.

The penalized loan amount given for each group is also listed as follows:

1. Shishu

Loans up to Rs.50,000 for those that are starting their business or are in its initial stages.

2. Kishor

Loan up to Rs.5 Lakh for those that have an established business and are looking to expand it.

3. Tarun

Loans up to Rs.20 lakhs to those that satisfy specific eligibility criteria.

Mudra Yojana Key Features

- Age Criteria: Minimum 18 years & Maximum 65 years

- Interest rate: Varies from bank to bank

- Minimum loan amount – No Limit

- Maximum loan amount is up to Rs. 20 lakh

- Collateral or Security: Not required

- Repayment Tenure: Up to 5 years

- Availed by Indian Citizen with no criminal background

- Applicants with no past loan defaults shall be considered

Who can avail Mudra Yojana

Mudra Loans could be availed for the following

- Vehicle loan: Commercial vehicle loan, Car loan, and Two-wheeler loan

- Business Instalment Loan (BIL): Loan for working capital requirement, buying plant and machinery, renovating offices, etc.

- Business Loans Group Loans (BLG) and Rural Business Credit (RBC): We offer Drop line overdraft/Overdraft facility/Working capital loans

Documents Required For Each category

- Vehicle Loans

-

- Mudra application form

- Vehicle loan application form

- 2 passport size color photographs

- Photo Identity proof

- Address proof

- Income proof

- Bank statement (last 6 months)

-

- Business Installment Loan

- Mudra application form

- BIL application form

- Photo identity proof • Address proof

- Establishment proof

- Bank statement (last 6 months)

- Ownership proof of residence/office

- Proof of continuity of business

- Proof of qualification

- Trade references

- 2 years ITR

- CA certified financials

- Business Loans Group and Rural Business Credit

- Mudra application Form

- BIL/RBC application form

- Photo identity and age proof

- Address proof

- Ownership proof of residence/office

- Business vintage proof

- Bank statement (last 12 months)

- Income tax return (last 2 years)

Click Here

Thank you for visiting our website. Stay connected with us for more knowledgeable things like this.