Although having your ideal home is an important financial achievement, it can be unsettling to consider a lengthy loan term. Fortunately, there are calculated methods to shorten the length of your home loan, which will enable you to become a homeowner more quickly and save money on interest. We’ll look at doable tactics and advice in this blog to assist you shorten the term of your house loan and live debt-free in your own house sooner than you might imagine.

Raise Your Monthly Installment:

Increasing your Equated Monthly Instalment is one of the easiest methods to shorten the term of your home loan (EMI). The length of your loan might be greatly impacted by even a small increase. Determine how much more you can afford to pay each month, then talk to your lender about modifying your EMI to reflect that amount. Take a look at this table to gain a better understanding of how a rising EMI can shorten the term of your house loan:

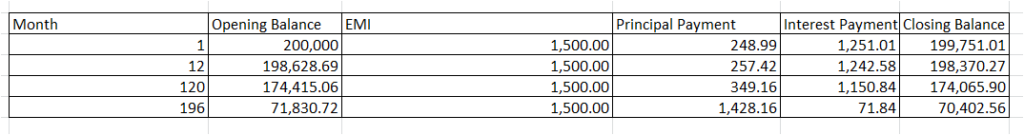

Home Loan Details:

Loan Amount: Rs. 200,000

Interest Rate: 6% per annum

Loan Tenure: 20 years (240 months)

You can see the effect of raising your EMI’s principal payment component in this table. The loan term is shortened from 20 years to 16 years and 4 months due to the higher EMI. This lowers the overall interest paid during the loan’s term in addition to causing an earlier loan payback.

Make Payments Every Two Weeks or Every Fortnight:

Consider making half of your EMI payment every two weeks rather than paying the entire amount due each month. This results in 26 half-payments (or 13 full payments) over the course of a year. This additional annual payment might significantly shorten the term of your loan.

Employ Bonuses and Windfalls:

Consider allocating a percentage of any unforeseen income, such as a bonus, tax refund, or inheritance, to lump sum principal payments on your house loan. The length of the loan is directly shortened by lowering the principal.

As we can see from the above table, a home loan’s term is directly shortened when the principal amount is reduced. For instance, if a borrower has a windfall of ?2,000,000 and has a ?10,000,000 home loan for 20 years, they can lower their principle amount to ?8,000,000. If they maintain the same EMI, this will shorten the loan term to 16 years.

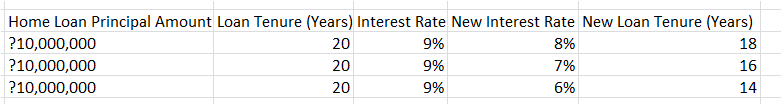

Refinance at Interest Rates That Are Lower:

Observe the market for interest rates. Refinancing your home loan at a lower interest rate may result in lower monthly payments and a shorter loan term. To make sure it’s financially feasible, do evaluate the refinancing charges.

Choose a Lower Loan Tenure Up Front:

Choose a shorter loan term right away if you intend to take out a new house loan or are already choosing a loan. Shorter terms can save you a lot of money in interest over time because they frequently have cheaper interest rates.

The aforementioned table illustrates how a house refinancing at a reduced interest rate can shorten the loan term. For instance, a borrower can refinance to a new loan with an interest rate of 8% if they have a home loan for ?10,000,000 that has been for 20 years at a 9% interest rate. If they maintain the same EMI, this will shorten the term of their debt to 18 years.

Bi-Annual or Annual Review of Home Loans:

Review your home loan with your lender on a regular basis to see if there are any opportunities to lower interest rates, change repayment plans, or raise EMIs.

In summary

In addition to being a wise financial decision, shortening the term of your house loan gets you one step closer to being a home owner. You can take control of your financial destiny and experience the peace of mind that comes with becoming a debt-free homeowner sooner than you may have imagined by putting these techniques into practice. Recall that every action you take to shorten the term of your house loan brings you one step closer to realizing your aspirations of becoming a homeowner.