Let us discuss it one by one in detail

1.Profile:

One of the important factor bank consider is your Profile. If you are a salaried and earning a good salary, sufficient to cover your EMI then most often you will be offered the best Rate of Interest in the market but if you are earning a Cash salary, you will probably end up with high Rate of Interest. On the other hand if you are a Self Employed there are various factors on which Rate of Interest depends. In case of Self Employed the following points are considered

- What is your occupation? If you are a Manufacturer, Trader or Retailer, you are a good profile for the Bank/NBFC. Whereas if you are a Jeweler, Real Estate Agent , Stock Broker , Builder etc whose income are risky or uncertain, you are negative for Banker

- Book Income/Cash Profit –Once the Profile is ok, If Cash Profit as per Books of Accounts is sufficient to cover your EMI then you have a chance of getting the best rate of interest.

- Cash Income : If you are in Business where Cash flow is more than Bank Account entries than you will get a rate little higher .Generally it is 50 bps higher than normal Rate of Interest

- Banks/NBFCs – Now there are so many Banks/NBFCs in the market. Each has cost of Funds associated with them which differ for everyone. So you have to be vigilant which Bank/NBFC can offer you.

2.Property:

After considering the Profile of the customer. Other factor which is being considered is Property, customer is going to mortgage. There are many types of Properties :

- Residential

- Commercial

- Industrial

- Hotel/ Restaurant

- Institutional

- Hospital/School/Colleges etc

Now after bifurcating properties on the above ground, Banks/NBFCs look at whether it is a Land or constructed and then whether it is Approved, Regularized, Lal Dora, Agriculture or any other criteria.

So all in all there are many things Banks/NBFCs look into before funding the property.

3.CIBIL:

Last important point which Bank/NBFC consider is CIBIL of the customer. Banks/ NBFCs generally prefer CIBIL score of more than 700. However low CIBIL score of around 600 can also be considered if customer has proper justification for the same. Also taking a call on Individual CIBIL differ from Bank to Bank.

In Conclusion if you are a Salaried or Self Employed with income in books which can cover Loan EMI and with Approved property, Excellent CIBIL score, you have a high chances of getting the Best Rate of Interest. On the other hand if you do not fall in the above category you can still get the loan but with Higher Rate of Interest

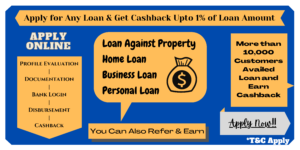

We at Win Capital are specialized in analyzing the profile of the customer and providing him with Best Deal. We analyze the profile without any charge. Just go to our Apply Now section and fill the form for whichever loan you want to take. We analyze the same within 24 working hours and give you the best advice.

Thank you for visiting our website. Stay connected with us for more knowledgeable things like this.